Overview of Ports’ Sustainable & Shore Power Ambitions

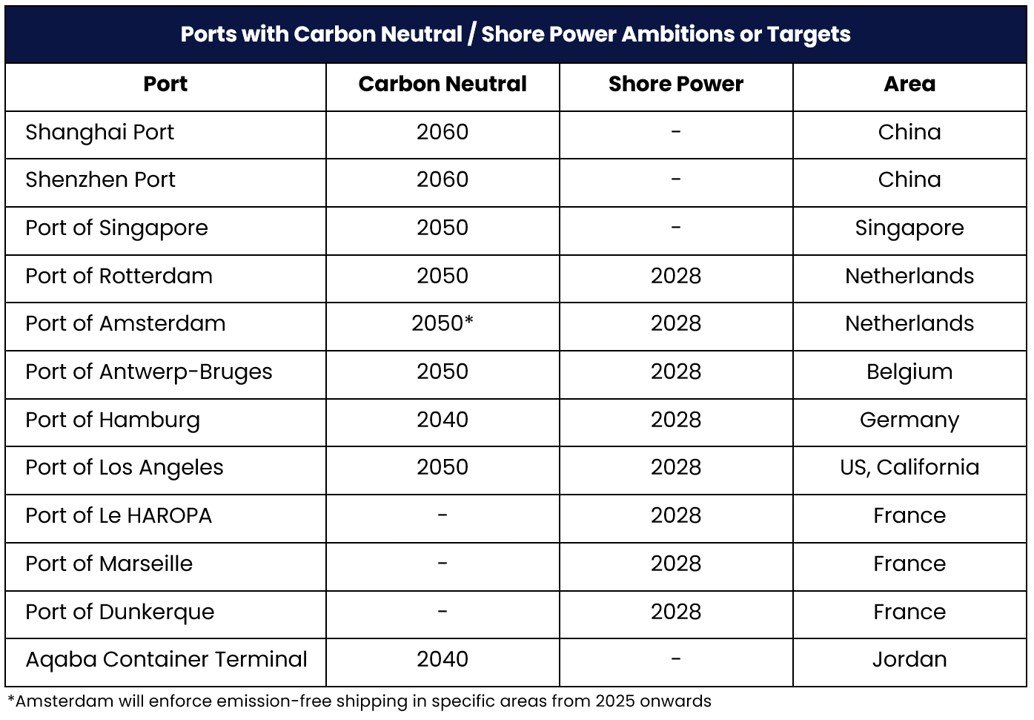

Target dates for carbon neutrality and shore power projects of ports

Summary - Most ports have the ambition to become carbon neutral by 2050. This typically excludes vessel emissions and focusses on Scope 1/2 port operations only. A significant portion of ports around the world have signed shore power declarations to ‘deploy shore-side electricity by 2028 where possible’, including all large North Sea ports, Los Angeles, Montreal and all large Japanese ports. Cruise and container vessels are the primary target for most ports’ regulations and EU will start taxing vessels via EU ETS from next year onwards.

While moored, 100 [kW] of auxiliary power will cost approx. €150 per day in EU ETS (price of €100 / mT CO2), or €50.000+ per year. Calculate your EU ETS costs here.

Not all ports are available. Works better on computer, not phone. This blog uses publicly available information updated until late 2022.

The maritime energy transition linchpin —> Ports

At some point, every ship needs to come home. Ports are the homes for all ships. And at some point, ports will need to become carbon neutral as well. Luckily, as can be seen from the below table, 9 out of 12 ports have indicated the ambition to become carbon neutral. Although this table is far from complete, it does highlight the inevitability of carbon neutrality of ports from around the world - and thus the ships coming home to them.

By far the most important aspect for ports to become carbon neutral - when focussing on ship or ‘floating’ emissions - is shore power. It is a key element in the fight for carbon neutrality. Cost-effective roll-out of shore power is thus top of mind for port policy makers. This can be very tricky though.

That is because ports might be the linchpin for implementing shore power, port authorities themselves can have have limited ‘power’ when it comes to port infrastructure. This is due to the fact that they are neither the consumer, nor the provider of shore power energy or technology. Port authorities act as the facilitator, or as investor in a limited amount of cases. Their ‘blessing’ is crucial to the development of shore power projects, but they need shipowners and shore power technology suppliers to build the infrastructure.

This understanding is highlighted in the signing of a ‘shore power declaration’ of a significant amount of major ports around the world, highlighted in the subsequent section.

One Ocean Summit 2022

Government ministers and port authorities from around the world signed a shore power declaration at the One Ocean Summit on February 10th, 2022. Joined by the European Investment Bank, the stakeholders agreed to make best efforts to deploy shore-side electricity supply by 2028, in particular for cruise and container vessels. Port signatories of the shore power declaration are stated below.

● Le Havre, Rouen, Paris (HAROPA) (France)

● Marseille (France)

● Dunkerque (France)

● Port of Breme (Germany)

● Port of Hamburg (Germany)

● Port of Antwerp-Bruges (Belgium)

● Port of Ostende (Belgium)

● North Sea Ports (Belgium Netherlands)

● Port of Amsterdam (Netherlands)

● Port of Rotterdam (Netherlands)

● Port of Copenhagen (Denmark)

● Port of Göteborg/Gothenburg (Sweden)

● Port of Malmö (Sweden)

● Port of Montreal (Canada)

● Port of Los Angeles (United States of America)

● Port of Busan (South Korea)

● Port of Osaka (Japan)

● Port of Kobe (Japan)

● Port of Yokohama (Japan)

● Port of Tokyo (Japan)

● Port of Tanger (Morocco)

The exact meaning of ‘best efforts’ remains to be seen, and for some ports it is a mere gesture. Port of Los Angeles for example already has to comply with near complete roll-out of shore power due to the Ocean Going Vessels at Berth regulation. Nevertheless the shear amount of signatories is a positive and welcoming sign to the maritime industry.

More stories

This is a case study on the ‘Skoon Skipper’, a general cargo large Rhine vessel, with an average of 40 [kW] power demand while moored to which a shore battery is applied. Batteries can help you comply with shore power regulations where no infrastructure exists with limited to no CAPEX investments. CAPEX is €0 for this case study as the battery pack is rented at an estimated €400 dayrate. Purchase cost for battery pack are approx. €350.000. This case study is powered by our preferred partner Skoon.

This is a story about how the shore power connection for Heerema in the Port of Rotterdam was realized from idea to reality. It is told from the perspective of Heerema, but could not be realized without help from Eneco, Siemens, Port of Rotterdam, the City Council of Rotterdam and InnovationQuarter. This story portrays the power of open collaboration for a sustainable future, and shows what can be achieved when working together on a common cause.

How a single project from Heerema - made possible by Sustainable Ships - kicked shore power developments in Rotterdam into high gear and led towards the Rotterdam Shore Power Strategy.

Stena Line realized a shore power connection for sea-going ferries of two times 3 [MW] in Hoek van Holland in 2012.

The Port of Marseille, headquartering CMA CGM, committed themselves, by signing a Blue Charter, to respecting rules that are much more stringent than national and international regulations. These include the use of shore power from 2025 for ships fitted with the equipment.

The Global Pricing Dashboard made by the World Bank is one of the most complete overviews carbon pricing initiatives worldwide. 23.17% of all global greenhouse gas emissions were covered in 2022. Only EU ETS aims to incorporate shipping emissions at the moment, others are expected to follow suit.

One of the most stringent ports in the world regarding shore power, which is mandatory by 2027 for all vessels by authority of CARB.

China officially aims for carbon neutrality “before 2060”. With legislation on carbon tax and fuel specifications upcoming but not yet active in the foreseeable years, main focus has been on the development of shore power infrastructure but the technology remains under-utilized in ports in the country.

Learn more about the targets, ambitions and upcoming rules and regulations of the Netherlands with regards to maritime sustainability here.

IMO aims for 11% carbon intensity reduction per 2026, 40% in 2030 and 70% reduction in 2050. MARPOL and MEPC are key regulatory bodies within IMO. Virtually all rules and regulations apply to vessels of 5.000 GT and above. The most important rules and regulations for shipowners to comply with are SEEMP (includes DCS and CII), EEXI/EEDI and Emission Controlled Areas (ECAs).

A global carbon tax has been proposed by an IMO working group, but the costs and effective date are far from known. Learn what is known about the proposed pricing here.

Cruise ships capable of accommodating more than 100 passengers in Sydney Harbour are required to limit emissions of sulphur oxides when berthing (maximum 0.10% m/m). It is like a mini-ECA in Sidney waters. Learn more here.

China’s coastal shipping sector is to implement low-carbon marine fuel regulations no later than 2030. Learn more about the low-carbon fuel regulations in China here.

China’s national ETS – the world’s largest in terms of covered emissions – started operating in 2021. Shipping is not included, for the moment. Learn more about ETS here.

Emissions from cruise ships and ferries in World Heritage Fjords are to be zero by 2026 latest. Read more here.

The ETD is the principal taxing scheme used for fossil and low-carbon fuels in EU. Fossil fuels will be taxed more, and renewable low-carbon fuels will receive incentives, including shore power.

RED targets supply side - production - of fuels in the EU, aiming for a 40% energy share from renewable sources by 2030.

AFIR targets the supply side of marine infrastructure and fuels in the EU, mandating the use of low-carbon fuels and shore power by 2030.

EU MRV is the CO2 reporting system in Europe, used for carbon tax determination. It is applicable to vessels of 5000 GT and above. It is expected to apply to 400 GT and above. Learn more about EU MRV here.

ECAs (Emission Control Areas) are sea areas that limit SOx or NOx emissions. Currently there are several ECAs active in North America and Europe. Learn more about ECAs here.

For ships operating outside Emission Control Areas (ECAs), the limit for sulphur content of fuel oil is 0.50% m/m (mass by mass). Learn more about the global sulphur limit for shipping here.

Learn all about the sustainable ambitions of the Port of Singapore, in particular with regards to shore power.

In the Netherlands, ‘Renewable Fuel Units’ (HBEs) are an economic incentive to gradually expand the use of green energy in transport and the reduction of greenhouse gasses. Fossil fuel producers are required to purchase HBEs from green fuel producers. The market is controlled by the Dutch Emission Authority. You can make up to €0.20 per green kWh sold. Learn more about HBEs here.

The Programma Aanpak Stikstof (PAS) is a Dutch law that strictly prohibits the deposition of NOx on environmental protection areas in the Netherlands. Impact on maritime operations can be severe - in particular for wind farm construction - required 80% NOx reduction on top of Tier III restrictions. Learn more about PAS here.

Port of Amsterdam has the ambition to become carbon neutral by 2050 but plans on a zero-emission zone of the inner city by 2025. Learn more about Port of Amsterdam’s sustainable ambitions and shore power here.

Port of Shanghai has the ambition to become carbon neutral by 2060. Learn more about the targets and ambitions of Shanghai with regards to maritime sustainability here.

Port of Hamburg has the ambition to become carbon neutral by 2040. It is one of the most ambitious ports in terms of sustainability in the world and has an installed capacity of 72 MVA of shore power by 2024. Learn more about the targets and ambitions of Port of Hamburg here.

The Ship Energy Efficiency Management Plan II (SEEMP II) is the updated version of the first SEEMP. It includes to obligation of vessels of 5000 GT and above to input CO2 data into the IMO Data Collection System (DCS). Learn more about SEEMP II and how it impacts your vessel’s operations here.

Learn all about the targets, ambitions and upcoming rules and regulations of the Unites Kingdom with regards to maritime sustainability.

Rosneft has the ambition to become carbon neutral by 2050. Learn all more about the targets and ambitions of Rosneft with regards to maritime sustainability here.

Sinopec has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Sinopec with regards to maritime sustainability here.

PetroChina has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of PetroChina with regards to maritime sustainability here.

Petronas has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Petronas with regards to maritime sustainability here.

Petrobras has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Petrobras with regards to maritime sustainability here.